The Anti-Fragile Startup: Building Business That Get Stronger When Things BreakWhy stability is often the most dangerous illusion in modern business, and how volatility, properly structured, becomes an advantageStability Is Often a Precursor to CollapseThe most dangerous systems are not always those under visible stress. They are often the ones who appear calm. Extended periods of stability change behavior. Risk feels distant. Safeguards are relaxed. Leverage increases. Margins of safety narrow. The absence of disruption becomes interpreted as proof that disruption has been eliminated.

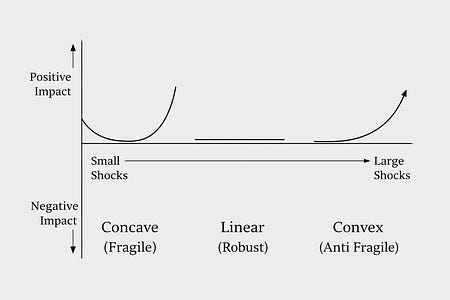

His insight was structural, not metaphorical. When markets experience long stretches of predictable growth, participants increase leverage because recent history suggests they can. Debt expands. Complexity deepens. Interdependence grows. The system appears strong precisely because its vulnerabilities are not being tested. The collapse of Lehman Brothers in 2008 illustrates the pattern. For years, Lehman accumulated large positions in mortgage-backed securities and financed them with borrowed money. As long as housing prices rose steadily, profits reinforced the perception of soundness. The structure held under ordinary conditions. But leverage introduces nonlinearity. When housing prices began to fall, losses were amplified across the firm’s balance sheet. Because Lehman had relatively little equity compared to its obligations, modest market stress translated into existential pressure. What appeared stable under one regime proved fatally exposed under another. The fragility had not been visible during calm. It had been embedded in the structure. History offers similar lessons outside finance. In the 1840s, Ireland relied heavily on a genetically uniform potato crop. When potato blight spread, the lack of genetic diversity meant there was no natural buffer. A plant disease became a national catastrophe. Uniformity had maximized output under normal conditions. It eliminated resilience under stress. In 1986, the Space Shuttle Challenger disintegrated shortly after launch because O-ring seals in the solid rocket boosters failed in unusually cold temperatures. The seals had shown vulnerability in previous launches. Under typical conditions, they performed adequately. Under edge conditions, the weakness became catastrophic. In each case, collapse was not caused by constant chaos. It was caused by structures optimized for normal conditions without sufficient tolerance for variation. Stability can conceal accumulated risk. Calm can be a warning sign. Fragile, Robust, and Anti-FragileIt was in response to this blindness toward hidden exposure that Nassim Nicholas Taleb introduced a third category in Antifragile. We are familiar with fragility. Fragile systems are harmed by volatility. A porcelain glass shatters when dropped. A highly leveraged firm collapses when asset prices decline. The defining characteristic is asymmetry. Small shocks cause disproportionately large damage. We also understand robustness. A robust system resists disturbance. A well-capitalized institution survives a recession. A steel beam withstands load without bending. Robustness is strength under stress, but it is neutral. The system endures. It does not improve. Taleb’s contribution was to identify something different.

Anti-fragile systems require variability. They improve because of stressors, randomness, and disorder. The human body offers a simple illustration. Muscles grow stronger through resistance training. Controlled micro damage triggers repair and adaptation. The immune system strengthens through exposure to pathogens. Evolution itself depends on variation and selection. Without mutation, adaptation stalls. The distinction lies in the response to volatility. Fragile systems experience negative asymmetry. Harm increases faster than benefit. Robust systems experience symmetry. Stress produces little net change. Anti-fragile systems experience positive asymmetry. Small stressors generate improvement.

The same external force destroys one structure and strengthens another. The difference lies not in the wind but in the design of the system. Most modern institutions are engineered for efficiency and predictability. They function exceptionally well when conditions remain within expected bounds. The difficulty is that real-world systems rarely remain within bounds. Volatility is not the exception. It is the rule. Economic Systems and the Accumulation of Hidden FragilityFragility does not emerge only in isolated institutions. It accumulates across systems. Modern economies reward efficiency. Capital is allocated toward optimization. Supply chains are streamlined. Redundancy is treated as waste. Slack is eliminated in the name of productivity. Under stable conditions, this produces impressive results. Margins expand. Output increases. Costs decline. The system appears intelligent because it functions smoothly. Yet efficiency often removes the very buffers that absorb stress. Global supply chains before the COVID pandemic provide a clear illustration. Just-in-time manufacturing minimized inventory and reduced storage costs across industries. Firms depended on precisely timed shipments that crossed continents. Under normal conditions, the system operated with remarkable precision. When transportation halted and factories shut down, minor disruptions cascaded globally. A shortage of semiconductors slowed automobile production. Delays in one port created ripple effects across entire sectors. The structure had been optimized for cost, not variability. The vulnerability was not visible during calm. It was structural. The same pattern appears in energy markets. Countries dependent on a single dominant supplier enjoy predictable pricing during peaceful periods. When geopolitical tension interrupts supply, the absence of diversification becomes strategic exposure. Systems that suppress volatility often accumulate fragility silently. Risk is not removed. It is deferred. This is why Taleb repeatedly warns against the illusion of control. Complex systems cannot be fully predicted. Attempts to smooth them completely often amplify future instability. The issue is not whether shocks will occur. It is whether the structure absorbs them gradually or collapses abruptly.

When Volatility Becomes a TeacherIf fragility describes disproportionate harm under stress, anti-fragile systems display the opposite pattern. They convert disorder into information. This dynamic can be observed in competitive markets. During the early months of the COVID crisis, many firms froze activity in response to uncertainty. Others treated the disruption as feedback. Consumer behavior shifted rapidly toward digital services. Companies that experimented quickly with new channels, pricing models, or delivery formats gathered data at high velocity. Volatility revealed weak assumptions and surfaced unmet demand. The video communications platform Zoom provides a useful example. When global usage surged, the platform experienced scrutiny over security vulnerabilities. Public criticism intensified. Rather than deflecting, founder Eric Yuan acknowledged shortcomings and redirected engineering resources toward strengthening encryption and privacy controls. Stress exposed weaknesses that might have remained secondary concerns in slower conditions. The organization adapted under pressure. Similarly, after rapid pandemic-driven expansion, Shopify faced a reversal in growth momentum. Leadership responded with restructuring and renewed focus on core merchant services. The adjustment was painful, but it clarified strategic priorities. In both cases, volatility did not merely threaten survival. It forced reassessment. It accelerated learning.

Pain without reflection leads to collapse. Reflection without exposure produces stagnation. Anti-fragility requires both. The defining question for any organization is not whether it encounters stress. It is how the structure processes it. Does pressure reveal information that strengthens the system, or does it trigger cascading breakdown? Volatility is constant. The asymmetry of response determines the outcome. The Company as a Volatility Processing SystemA company can be understood as a structure that processes uncertainty. Revenue fluctuates. Costs fluctuate. Regulation shifts. Technology evolves. Consumer behavior drifts. Every organization exists in moving conditions. The question is not whether external shocks occur. It is how internal architecture responds to them. Some firms are tightly coupled systems. Decision-making is centralized. Revenue depends heavily on a single product line or channel. Costs are calibrated to current demand. Margins leave little room for error. Under stable conditions, this design produces efficiency and clarity. Under stress, it magnifies exposure. Highly leveraged firms illustrate this clearly. During periods of rising asset prices, debt amplifies returns. When prices decline, the same leverage accelerates losses. The structure that rewarded optimism punishes reversal. The same structural principle appears in platform dependency. Early in its growth, Zynga relied heavily on distribution through Facebook. As long as platform algorithms favored social gaming, user acquisition scaled rapidly. When platform policies shifted, growth contracted sharply. The internal product did not fail overnight. The external dependency introduced asymmetry. Fragility often hides inside concentration. By contrast, firms that distribute exposure across products, geographies, suppliers, and revenue models tend to experience smaller localized failures rather than systemic collapse. Diversity reduces the chance that one shock becomes existential. Consider Atlassian. For much of its history, Atlassian relied on product-led growth rather than a large enterprise sales force. Its distribution model reduced dependence on high fixed sales overhead. This did not eliminate risk. It altered the shape of risk. Lower structural fixed costs meant that downturns did not automatically trigger unsustainable burn. Anti-fragility does not imply immunity. It alters how stress propagates through the system. In tightly coupled structures, stress travels quickly and amplifies. In modular structures, stress is compartmentalized and informative. Optionality and the Preservation of Convex OutcomesTaleb frequently uses the language of convexity to describe anti-fragile systems. Convexity refers to payoff asymmetry. Losses are limited. Gains can expand. In practical terms, convex systems survive small errors while remaining exposed to large positive surprises. One way organizations create convexity is through optionality. Optionality preserves the ability to change direction without catastrophic cost. The marketing platform Mailchimp offers a useful example. For decades, the company operated without venture capital funding. This choice limited growth speed but preserved independence. Without the pressure of external capital cycles, strategic decisions were not constrained by fundraising timelines or investor mandates. When Intuit acquired Mailchimp in 2021 for approximately 12 billion dollars, the outcome was not the result of hyper-leveraged expansion. It was the product of sustained profitability and retained choice. Optionality increases the range of possible favorable outcomes while containing downside exposure. This principle also applies to experimentation. Small-scale trials allow organizations to test new markets or products without risking core stability. If the experiment fails, the loss is bounded. If it succeeds, the upside can scale. Anti-fragile structures tend to favor many small, reversible decisions over a few large irreversible bets. The goal is not constant disruption. It is controlled exposure. Convex systems welcome variation because they are positioned to gain more from favorable deviations than they lose from unfavorable ones. The alternative is concavity. In concave structures, the upside is capped while the downside expands rapidly. Highly leveraged expansions, single-channel dependence, or narrow product concentration often create this profile. The distinction between convex and concave exposure rarely appears during stable periods. It becomes visible when conditions shift. Volatility does not create structure. It reveals it. Taleb sharpens this idea further when he writes:

Leadership Under Stress and the Human VariableStructures do not operate independently of the people who guide them. Even well-designed systems can become fragile when leadership interprets volatility as personal failure rather than structural feedback. Stress reveals assumptions. It also reveals the ego. When growth slows or public sentiment shifts, leaders often face a psychological fork. One path seeks denial, external blame, or defensive escalation. The other path treats volatility as diagnostic. Reflection converts disorder into learning. Without reflection, pain compounds without insight. Corporate history offers multiple examples of leaders who treated volatility as a signal rather than a threat to identity. During the post-pandemic slowdown, Shopify recalibrated after overexpansion. Leadership publicly acknowledged misjudgments about the permanence of pandemic-driven demand and refocused on core merchant tools. The admission was uncomfortable. It was also adaptive. The capacity to detach the ego from the strategy becomes a structural variable. In rigid leadership cultures, negative feedback is suppressed. Teams optimize reporting upward rather than adapting outward. Small problems remain unaddressed until they accumulate into large failures. In reflective cultures, friction surfaces earlier. Dissent is tolerated. Weak signals are examined rather than dismissed. This allows incremental correction before volatility escalates into a crisis. Anti-fragile organizations are rarely loud about their adaptability. They simply adjust faster than their environment deteriorates. Psychological rigidity can render even financially sound institutions vulnerable. Intellectual humility, by contrast, introduces elasticity into decision making. The human layer is not separate from structure. It is part of it. The Acceleration Problem in the Age of AIThe current technological environment compresses cycles dramatically. The rise of generative models from firms such as OpenAI has reduced the time required to build, prototype, and deploy new products. Barriers to entry fall. Iteration speeds increase. Competitive landscapes shift within months rather than years. Acceleration amplifies exposure. When product differentiation erodes quickly, companies built on narrow advantages face rapid commoditization. When tools are widely accessible, defensibility shifts from technology to distribution, trust, and adaptability. Volatility increases not only because markets fluctuate, but because innovation itself accelerates. This environment intensifies the cost of structural fragility. Heavy fixed investments in a single technical architecture may become obsolete quickly. Overreliance on a single model provider introduces platform risk. Excess hiring during expansion cycles becomes difficult to unwind when momentum slows. At the same time, acceleration enhances the potential for anti-fragility. Faster feedback loops mean assumptions can be tested rapidly. Small-scale experiments can generate insight within weeks. Companies that treat technological change as continuous input rather than episodic disruption can refine more quickly than competitors anchored to previous models. The compression of time increases both downside and upside asymmetry. In slow environments, fragility unfolds gradually. In fast environments, it is exposed almost immediately. The decisive variable is structural flexibility. Organizations that preserve optionality, diversify exposure, and maintain adaptive leadership can metabolize acceleration as information rather than as a threat. Technology does not create fragility or anti-fragility. It magnifies what is already present. Optimization Culture Versus Exposure CultureMuch of modern management thinking is built around optimization. Optimize for margin. Optimization assumes stable constraints. It assumes that yesterday’s variables will persist long enough for fine-tuning to matter. Under those conditions, efficiency is rewarded. But optimization often narrows tolerance. When systems are tuned tightly to current conditions, small deviations produce disproportionate strain. Buffers are removed because they appear unnecessary. Redundancy is eliminated because it appears inefficient. Slack is treated as waste rather than protection. This logic works in linear environments. It fails in nonlinear ones. Anti-fragility requires a different orientation. It is less concerned with perfect calibration and more concerned with survivability under variation. It accepts small losses as the price of long-term durability. It favors modularity over tight coupling. It privileges optionality over precision. Optimization culture asks, “How do we maximize output under these conditions?” Exposure culture asks, “What happens if these conditions change?” The difference is philosophical. One worldview assumes stability and treats volatility as an interruption. The other assumes volatility and treats stability as temporary. The anti-fragile organization does not attempt to eliminate randomness. It structures itself so that randomness is more likely to generate insight than ruin. This shift in posture is subtle but profound. It changes hiring decisions, capital allocation, supplier relationships, and product design. It changes how leaders interpret negative feedback. It changes how success is measured. A fragile system becomes brittle because it believes the world is predictable. An anti-fragile system remains adaptive because it assumes the opposite. Designing for DisorderVolatility is not an anomaly in economic life. It is a permanent feature. Technological disruption, geopolitical shifts, capital cycles, regulatory change, and cultural evolution ensure that no equilibrium persists indefinitely. Attempts to engineer permanent calm often postpone and intensify eventual disruption. The anti-fragile company does not romanticize chaos. It does not pursue reckless exposure. It acknowledges limits. It bounds downside risk. It preserves room to maneuver. Most importantly, it learns faster than conditions deteriorate. This is ultimately the defining characteristic. In fragile systems, stress accumulates silently until failure is abrupt. In anti-fragile systems, stress is surfaced early and integrated incrementally. The difference is temporal. Fragile systems postpone feedback. Taleb’s insight remains deceptively simple. Some structures are harmed by volatility. Others gain from it. The question is not whether disruption will occur, but whether it will reveal weakness or produce adaptation. In complex environments, permanence is an illusion. Endurance belongs not to the largest, nor to the most optimized, but to those designed with humility toward uncertainty. The anti-fragile startup is not built for smooth quarters. It is built for the moment when smoothness ends. And in a world defined by acceleration, that moment always arrives. - Have early traction but an unclear revenue signal? One-Week Market Signal Test ($30) Validate demand. Decide with proof. |

Entrepreneur Examples

Monday, March 2, 2026

The Anti-Fragile Startup: Building Business That Get Stronger When Things Break

Monday, February 23, 2026

The Most Dangerous Phase of a Startup Isn’t Idea Stage

The Most Dangerous Phase of a Startup Isn’t Idea StageOn repeatability, restraint, and the illusion of progress

The danger of early revenue is not that it lies. Revenue answers a single question: Did someone pay? Did they succeed again? In early growth, founders often mistake payment for proof. A customer paid, therefore, the value proposition is validated. A cohort converted; therefore, the funnel works. A few strong accounts expanded, therefore the model scales. But revenue in this phase behaves more like a coincidence than a system.

It arrives because of timing, motivation, luck, or exceptional customers. It shows up when the founder is involved. It disappears when conditions change. And because the numbers move in the right direction, the underlying fragility is easy to ignore. This is why this phase is so dangerous. It does not feel like failure. It feels like progress that cannot yet be trusted. What makes it worse is that most startup narratives skip directly from zero to inevitability. There is little language for the space in between, where outcomes exist but refuse to stabilize. That silence pushes founders toward the wrong instinct. Instead of slowing down to understand why success happens, they accelerate to capture more of it. They scale before they explain. The Gap Between “Working” and “Working as a Business”A product can work while the business does not.

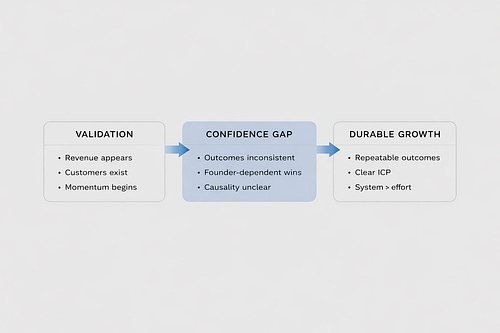

This is the distinction that separates early traction from durable growth, and it is rarely made explicit. A product works when someone derives value from it. In the early growth phase, most startups live in the gap between those two definitions. Success depends on context. Certain customers thrive while others stall. Results vary by segment, by timing, by geography, or by how closely the founding team is involved. The same pitch produces wildly different outcomes. The same onboarding leads to opposite results. From the inside, this feels confusing rather than alarming. Founders often assume the inconsistency is noise. With more volume, they believe, the signal will emerge. Sometimes that is true. Often it is not. What is actually happening is simpler and more uncomfortable. The business does not yet know which parts of its success are structural and which are accidental. Until that distinction is clear, growth multiplies both equally. This is why scaling too early does not just amplify success. It amplifies misunderstanding. Why This Phase Is More Dangerous Than the Idea StageThe idea stage is visibly risky. Everyone expects things to break. Doubt is built into the process. Early growth is different. By the time a startup reaches this phase, confidence has already crept in. Customers exist. Money flows. External validation begins to arrive. Internally, the pressure shifts from discovery to execution. That is precisely what makes this phase more dangerous. Founders stop asking foundational questions too soon. Teams begin optimizing around metrics that have not yet proven durable. Decisions are justified by trends that have not stabilized. The organization starts behaving as if uncertainty has been resolved, when it has only been postponed. In the idea stage, failure feels acceptable. So instead of interrogating inconsistency, companies explain it away. They blame edge cases. They blame customer quality. They blame execution. Anything except the possibility that the business model itself is not yet repeatable. This is how promising startups drift into a quiet kind of failure. Not by running out of demand, but by building momentum on top of assumptions that were never stress-tested. The tragedy is that many of these companies could have survived if they had treated this phase with the same skepticism they applied at the beginning. Naming the Phase Nobody Prepares You ForEvery meaningful phase in a startup’s life has a language attached to it. Idea stage. But the phase that sits between validation and growth rarely gets named, which is why it is so often mishandled. This is the phase where the business produces outcomes, but only under specific conditions. Where success exists, but only when the right customers show up, the right people are involved, or the right effort is applied. Where results are real, but fragile. It is not pre-product market fit. It is something else entirely. This is the confidence gap. The confidence gap is where a startup has enough evidence to believe in itself, but not enough understanding to trust itself. Revenue creates momentum, but predictability has not yet arrived. Decisions feel urgent, but the foundations are still shifting. What makes this phase so difficult is that it looks deceptively stable from the outside. There are numbers to point to. Customers to reference. Progress to report. Internally, however, the company is still guessing. Until that gap is crossed, growth is not a strategy. It is a stress test.

What most founders experience but rarely articulate is not a leap from validation to scale. It is a transitional phase where evidence exists, but confidence does not. Visually, it looks like this: The first stage is visible and energizing. Revenue appears. Customers exist. Momentum builds. The last stage is durable. Outcomes repeat. Systems replace effort. Growth compounds without heroics. The middle stage is where uncertainty hides inside progress. This is where many startups mistake movement for mastery. How Founders Accidentally Make the Gap WorseThe confidence gap does not close on its own. In fact, most founder behavior during this phase quietly widens it. When outcomes are inconsistent, the instinct is to push harder. More leads. More features. More markets. More hiring. The belief is that volume will smooth out variability. Sometimes it does. Often, it simply hides it. Founders step in to save deals that should fail. They customize onboarding for customers who do not fit. They tolerate edge cases because revenue feels precious. Over time, the company learns the wrong lesson. It learns that success requires intervention. The founder becomes the glue holding together a business that has not yet learned to hold itself. This creates a dangerous illusion. From the inside, effort feels like progress. From the outside, growth appears real. But the organization is not learning what makes the business work. It is learning how to compensate when it doesn’t. The longer this continues, the harder it becomes to tell the difference. By the time the founder tries to step back, the signal is already polluted. What Actually Closes the Confidence GapThe confidence gap closes the moment a company can answer a very specific question with clarity. Why does this work? Not in slogans. But in observable patterns. Which customers succeed and why? This is not a growth exercise. It is a reduction exercise. It requires saying no to customers who distort learning. It requires resisting opportunities that generate revenue but confuse causality. It requires slowing down at the exact moment speed feels justified. The companies that survive this phase do something counterintuitive. They trade short-term momentum for long-term confidence. They choose understanding over optics. Once that understanding exists, growth becomes less dramatic. Less emotional. Less heroic. It also becomes far more dangerous to competitors. Because from that point on, success is no longer dependent on effort. It is embedded in the business itself. What Happens When Companies Skip This PhaseMost startups do not consciously decide to skip the confidence gap. They simply grow past it. They raise capital on early momentum. At first, this looks like success. Revenue increases. Headcount grows. The organization becomes busier. There is always movement, always urgency, always another lever to pull. But underneath the activity, the same inconsistencies remain. Customer outcomes still vary wildly. Sales cycles still depend on who is involved. Expansion works in some cases and fails inexplicably in others. At scale, these inconsistencies become structural. Processes are built around exceptions. Teams optimize for edge cases. Complexity accumulates faster than insight. What was once a small gap between working and repeatable becomes embedded into the company’s operating model. By the time leadership recognizes the problem, it is no longer a phase issue. It is an organizational one. This is why so many companies appear to stall suddenly after periods of rapid growth. The stall is not sudden. It is delayed recognition. Why This Phase Is Often Misread by InvestorsFrom the outside, early growth looks reassuring. There is revenue to analyze. Cohorts to inspect. Pipelines to review. The surface-level signals all suggest progress. What is harder to see is causality. Investors, like founders, are trained to look for momentum. When numbers move in the right direction, they assume understanding will catch up. Often, it does. Sometimes, it never does. The confidence gap is difficult to spot because it hides behind averages. Strong customers mask weak ones. Founder-driven wins distort sales data. Early adopters behave differently from the market that follows. The business looks healthier in aggregate than it actually is in practice. This is why some of the most painful corrections happen after funding events, not before. Capital accelerates a model that has not yet learned how to repeat itself. The result is not a collapse. It is drift. A slow divergence between what the company believes about its business and how the business actually behaves. The Quiet Difference Between Fragile and Durable GrowthFragile growth feels intense. It demands attention. Durable growth feels almost boring by comparison. The same customers succeed for the same reasons. The same actions lead to the same outcomes. New hires perform well without tribal knowledge. Revenue grows without improvisation. The difference is not ambition. Companies that cross the confidence gap stop chasing proof and start building evidence. They stop celebrating isolated wins and start studying patterns. They replace urgency with clarity. This is why the most dangerous phase of a startup is not when nothing works. It is when enough works to convince you that you no longer need to ask why. That moment feels like an arrival. One path leads to businesses that compound quietly over time. Most never realize which path they are on until it is too late. What Changed for the Companies That SurvivedWhat separates the companies that cross the confidence gap from the ones that don’t is speed or conviction. It is a restraint.

Growth did not disappear when the company slowed down to study this. It clarified.

In both cases, success followed subtraction. The business became simpler, not bigger. This is how the confidence gap closes. Not through momentum, but through understanding. Why This Phase Is So Rarely Written AboutThere is a reason this phase is missing from most startup narratives. It is uncomfortable to admit uncertainty after success. Founders are expected to project confidence once revenue arrives. Investors reward clarity, not hesitation. Teams look for direction, not doubt. Public storytelling compresses time and removes ambiguity. So this phase gets edited out. The jump from early traction to inevitable growth becomes seamless in hindsight. The questions that once kept founders awake at night are replaced by neat explanations and polished lessons. But the lived experience is different. Most founders who have built enduring businesses remember this phase vividly. The unease. The inconsistency. The sense that the company was moving forward without fully knowing why. They just rarely talk about it publicly. That silence leaves new founders unprepared. They assume confusion means failure, when in reality it often means they are standing at the most important threshold of the company’s life. The Real Risk Is Misreading ProgressThe most dangerous mistake a founder can make is not believing in their idea enough. It is believing in early progress too much. When something works once, the temptation is to protect it, scale it, and defend it. When it works twice, the temptation is to trust it. When it works a few times in a row, the temptation is to stop questioning it altogether. That is when learning slows. The confidence gap does not announce itself. It hides inside good news. It disguises itself as traction. It convinces smart people to move faster than their understanding allows. The companies that survive are not the ones that avoid this phase. Everyone passes through it. They are the ones who recognize it for what it is. A moment not to prove, but to explain. But “Do we know why it works?” Answer that honestly, and growth stops feeling fragile.

That is why the most dangerous phase of a startup is not the idea stage. It is the moment success arrives before certainty does. - Have early traction but an unclear revenue signal? One-Week Market Signal Test ($30) Validate demand. Decide with proof. © 2026 Startup-Side |

The Anti-Fragile Startup: Building Business That Get Stronger When Things Break

What makes a startup anti-fragile? Explore Taleb’s theory of fragility, convexity, and how companies can gain from volatility and rapid chan...

-

Crypto Breaking News posted: "Mikhail Fedorov, Ukraine's Deputy Prime Minister and the head of the country's Minist...

-

Techie.Buzz posted: " [ANN] Serverless Kubernetes Solution For Cloud-Native Apps by CTO.ai CTO.ai is a provider of deve...

-

kyungho0128 posted: "China's crackdown on Bitcoin (BTC) mining due to energy consumption concerns is widely regarded as...