Adaptive Pricing Isn’t New - We Just Gave It AlgorithmsWhat Street Vendors Understand About Pricing That Startups Don’tGlobally, over 2 billion people participate in the informal economy in some form. In India alone, roughly 80–90% of the workforce operates in informal or livelihood-driven activity. And, they all have something in common when it comes to their pricing game.

They don’t call it dynamic pricing. None of them has dashboards. But all of them are constantly processing signals - demand shifts, cash flow pressure, customer loyalty, competitive density, time sensitivity. They are adjusting prices and economic terms in real time. Adaptive pricing didn’t begin with algorithms. It began with necessity. Pricing Is InformationAt its core, pricing is not a number. It is a response to information. The vegetable vendor sees foot traffic thin out by late afternoon. Perishability increases. Bargaining power shifts. Prices move. The mechanic extends informal credit to a loyal customer not out of generosity, but because repeat business and social capital lower repayment risk. The gig driver doesn’t just chase surge - they respond to platform-level signals, weather shifts, demand density, and bonus incentives. Their earnings depend on how quickly they interpret these moving variables. These markets are visible. Feedback is immediate. Signals are human-readable. Startups operate in a different environment. Signals are delayed. You can’t stand in your market and “see” it. So you build systems to translate it.

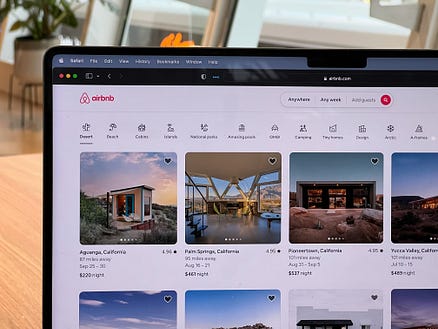

Adaptive pricing, at scale, is simply the industrialization of signal processing. From Intuition to AlgorithmsTake Uber’s surge pricing model. The public often frames surge pricing as a controversial innovation. But surge is simply a formalized response to supply-demand imbalance, something taxi drivers have informally practiced for decades during rainstorms or peak traffic. Uber codified that logic into a system that continuously measures rider demand and driver availability, adjusting prices accordingly to restore equilibrium. The difference is not the behavior. Similarly, before Airbnb introduced Smart Pricing, hosts manually adjusted rates based on intuition - seasonality, local events, and occupancy rates. Airbnb’s Smart Pricing tool transformed that intuition into algorithmic recommendations by incorporating historical booking data, search behavior, and local demand patterns. Again, the platform didn’t invent variable pricing. None of these companies “decided to be dynamic.” They built systems capable of absorbing more signals than any human could process. That’s the real shift. When markets scale beyond human visibility, pricing becomes an infrastructure problem. What Actually Powers Near-Real-Time PricingUnderneath every adaptive pricing engine is not magic. It’s signal architecture. Modern pricing systems ingest multiple streams of information simultaneously:

In hospitality, platforms like Booking.com dynamically adjust price visibility and ranking influence based on booking windows, search intensity, and competitive positioning. Their pricing logic interacts directly with demand forecasting and occupancy optimization. In streaming, Netflix has gradually differentiated pricing by region and plan tier, informed by historical elasticity data and content licensing economics. ‘ Their quarterly reports frequently reflect price adjustments aligned with regional performance data. In each case, the sophistication of pricing correlates with the sophistication of signal capture. The street vendor adjusts prices based on the foot traffic they can physically see. Netflix adjusts prices based on millions of data points across subscriber cohorts. The principle is identical. The scale of signal processing is not. And this is where many founders misunderstand adaptive pricing. It isn’t about deploying machine learning. It is about whether your organization can reliably capture, interpret, and act on the signals your market is already generating. Without clean signals, dynamic pricing doesn’t optimize outcomes. It amplifies noise. When Pricing Outpaces SignalAdaptive pricing becomes dangerous when its sophistication exceeds the reliability of the signals feeding it. It’s tempting - especially in high-growth environments - to assume more dynamic equals more optimized. History suggests otherwise. Take MoviePass. The company introduced a subscription model that allowed customers to watch unlimited movies in theaters for a flat monthly fee. On paper, it looked like an aggressive pricing disruption. In reality, it was a pricing system detached from marginal cost reality. The company underestimated how usage intensity would spike once friction disappeared. The issue wasn’t boldness. It was a signal miscalculation. Their pricing model assumed predictable usage patterns. The data environment didn’t support that assumption. When customers behaved rationally - maximizing the value of unlimited access - the economics collapsed. Or consider WeWork. The company’s pricing strategy relied on long-term lease obligations paired with short-term flexible memberships. The pricing architecture created liquidity exposure tied to occupancy volatility. When growth slowed and capital tightened, the structural mismatch became visible. Again, the failure wasn’t creativity. It was a misalignment between pricing logic and economic signal stability. In both cases, pricing systems projected confidence beyond the clarity of underlying data. When pricing becomes more sophisticated than your signal quality, you don’t optimize - you hallucinate. The Invisible Constraint: Signal MaturityFounders often treat pricing as a positioning decision. It’s not. It’s a measurement problem. The street vendor can change prices twice a day because the signal loop is tight. Feedback arrives in hours. Startups operate in slower, noisier feedback environments. Customer acquisition cost unfolds over months. You cannot responsibly deploy near-real-time pricing logic if your feedback cycles are structurally delayed. This is why companies like Stripe evolved pricing gradually, anchored to transaction volume data and infrastructure costs rather than speculative elasticity modeling. Stripe’s pricing page looks simple - a flat percentage plus fee - but that simplicity masks years of observing transaction behavior and merchant economics. Sophistication followed signal maturity. Not the other way around. In contrast, when companies rush into dynamic discounting engines or complex usage-based models without clean segmentation, they introduce volatility into already uncertain systems. Pricing starts changing faster than the organization understands why. Revenue teams lose narrative clarity. The constraint isn’t ambition. It’s informational coherence. Survival Pricing vs Scale PricingThe vegetable vendor adjusts pricing to avoid spoilage before sunset. The startup adjusts pricing to optimize lifetime value over the years. The home-based tailor diversifies income streams to smooth seasonal volatility. The venture-backed company introduces tiered plans to smooth revenue volatility across customer segments. The mechanic extends informal credit based on trust and repayment history. The SaaS company experiments with annual contracts to reduce churn risk. The gig driver toggles between platforms to optimize real-time earnings. The marketplace platform adjusts incentive bonuses to balance liquidity. The behaviors mirror each other. What differs is the abstraction layer. Livelihood entrepreneurs operate in compressed time horizons. Risk is immediate. Feedback is visible. Pricing decisions are embedded in daily survival. Startups operate across extended time horizons. Risk compounds. Feedback is statistical. Pricing decisions are embedded in capital allocation models. Both are responding to uncertainty. But one relies on human intuition shaped by proximity. The other relies on infrastructure built to interpret distance. That’s the real difference between survival pricing and scale pricing. Not intelligence. Not ambition. Infrastructure. The Real Moat Isn’t Dynamic PricingFounders often ask: These are downstream questions. The upstream question is simpler: How clean are the signals your organization produces? Do you know: Which segments are truly price sensitive? Without that clarity, dynamic pricing becomes performative. It looks sophisticated. It feels modern. It signals innovation. But beneath the surface, it’s guessing. The companies that sustain adaptive pricing at scale - Uber, Amazon, Netflix - are not merely good at adjusting prices. They are relentless about capturing, cleaning, and structuring information. Adaptive pricing is not a pricing strategy. It is a reflection of how well your organization understands motion inside its market. The vegetable vendor doesn’t need machine learning because the market is visible. Startups build pricing infrastructure because their markets are opaque. Before you automate pricing decisions, ask whether your system deserves automation. Pricing rarely breaks because founders are irrational. It breaks because signal maturity lags ambition. And growth exposes that gap before anything else does. - Have early traction but unclear revenue signal? One-Week Market Signal Test Validate demand. Decide with proof. |

Monday, February 16, 2026

Adaptive Pricing Isn’t New - We Just Gave It Algorithms

Subscribe to:

Post Comments (Atom)

Adaptive Pricing Isn’t New - We Just Gave It Algorithms

From street vendors to surge pricing, this essay explores why real-time pricing depends on signal maturity - not just data or AI models. ͏ ...

-

Crypto Breaking News posted: "Mikhail Fedorov, Ukraine's Deputy Prime Minister and the head of the country's Minist...

-

kyungho0128 posted: "China's crackdown on Bitcoin (BTC) mining due to energy consumption concerns is widely regarded as...

-

lovesarahjacobs posted: "Download our free Coinbase pro app and receive signals on your mobile – https://play.google.com/st...

No comments:

Post a Comment