Early Growth Is Not Scaling. It Is the Search for Repeatability.Why the real work between validation and scale is discovering what actually repeatsMost companies believe they are in early growth, far earlier than they actually are. What they usually mean is that usage is increasing, people are excited, and something appears to be working. Momentum feels real. Conversations are easier. The product is no longer being questioned at every turn.

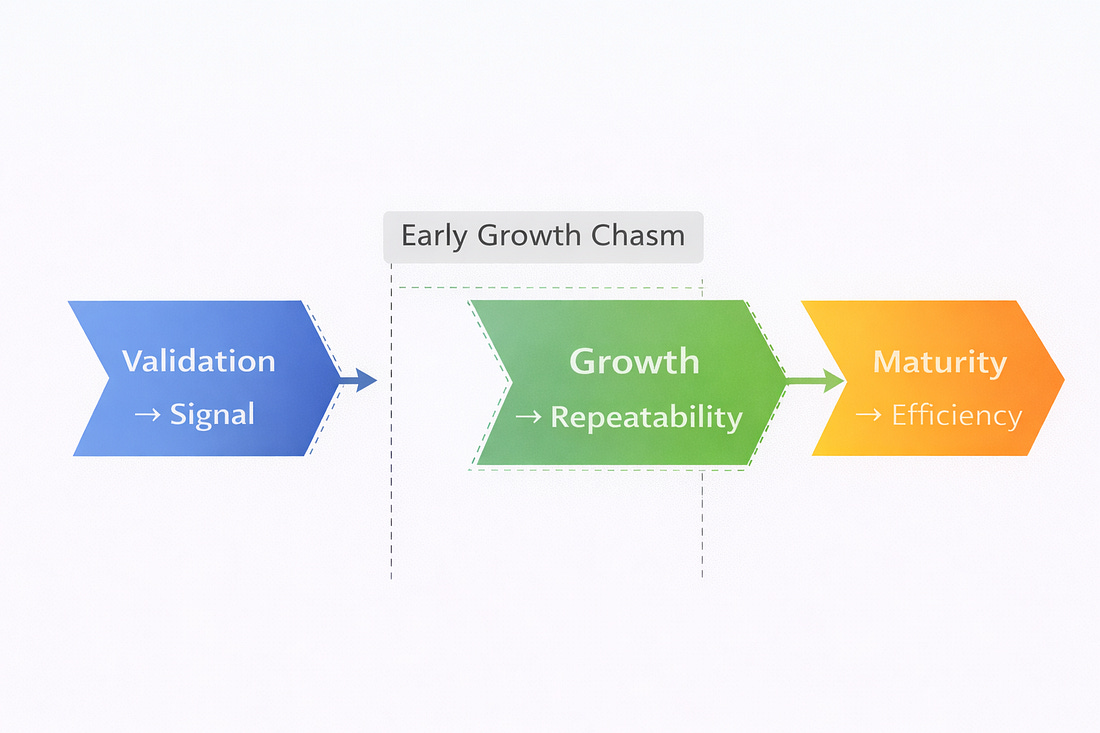

What they do not yet have is something far more fragile and far more important. They do not yet have repeatability. This gap between validation and real growth is the most misunderstood phase of company building. It is not talked about much because it does not feel like success or failure. It feels like motion without clarity. And that is exactly why so many promising companies stall there. Validation Produces Signals. Growth Requires Engines.Validation answers a narrow and forgiving question. Does this need to exist at all? Growth answers a much harsher one. Can this produce revenue repeatedly under imperfect conditions without constant founder intervention? These questions are often treated as adjacent steps. In reality, they belong to different mental models. Validation lives in anecdotes. Validation is about moments that prove possibility. Signals feel convincing because they are real. Someone paid. Someone cared enough to complain. Someone told a friend. But signals are not engines. An engine is something you can stress, degrade, and expose to randomness, and it still works. Early growth is not about increasing output. It is about discovering whether an engine exists at all. Between Validation and Growth Sits an Uncomfortable PhaseBetween validation and growth sits a phase that rarely gets named because it is uncomfortable, messy, and deeply unglamorous. This phase is early growth, and its job is not expansion. Its job is discovery. You are no longer asking whether anyone wants this. That question has been answered well enough. You are now asking harder questions. Why did this customer buy, but that one did not? Early growth is not a growth phase in the way people usually mean it. It is a business model investigation. You are dissecting reality, not scaling it. Visualizing the Early Growth GapTo make this distinction concrete, it helps to visualize where most companies actually stall. Not at validation. But in the gap between them. This is the phase where signals exist, momentum feels real, and yet nothing is stable enough to build on. The company looks like it is growing from the outside, but underneath, the economics are still fragile and founder-dependent. Here is what that gap really looks like. Validation produces signals. Growth requires repeatability. Early growth is the gap between them. Read the diagram from left to right, but do not mistake it for a simple timeline. Validation produces a signal. A few customers pay. A channel works once. A feature delights a narrow group. This is real progress, but it is isolated progress. The early growth gap is the space where those signals must be interrogated. This is not a waiting room. It is a proving ground. Growth only begins once repeatability has been discovered. And maturity only matters after that. Revenue Is Not a Metric. It Is a Diagnostic Tool.In early growth, revenue is not about scale. It is about truth. Revenue forces decisions. It introduces friction. It reveals incentives. It exposes whether interest turns into commitment. Usage can mislead. Engagement can mislead. Retention can mislead. Revenue rarely does. That is why early growth is inseparable from fast revenue validation. Not because money is the goal at this stage, but because money collapses ambiguity. When someone pays, they answer questions you did not know how to ask. They tell you what they value, what they tolerate, and what they are willing to change. The Question Is Not Can We Make MoneyMost teams frame monetization incorrectly. They ask when to monetize, how to price, or whether charging will slow adoption. These are secondary questions. The primary question is behavioral. What behavior produces revenue, and can that behavior be reproduced without the founder in the room? Early growth is the search for that answer. Not for funnels or pricing pages or growth tactics, but for a repeatable exchange of value. Repeatability Lives in Human BehaviorFounders often describe repeatability in terms of mechanics. Outbound works. Content converts. Freemium scales. These statements are downstream symptoms, not root causes. Repeatability lives in human behavior. What problem context triggers urgency? Until those answers stabilize, scaling tactics add noise. You cannot optimize what you do not yet understand.

The Early Growth Trap of False PositivesThe most dangerous moment in company building is when something works, but you do not know why. A channel performs unusually well early. These are not failures. They are unlabeled data. The danger is mistaking them for confirmation rather than clues. Early growth is about converting coincidences into hypotheses, then killing those hypotheses as fast as possible. Speed matters here, but only in one direction. Toward falsification. Quibi is an example of what happens when early signals are scaled before repeatability is understood. At launch, Quibi had validation signals that looked compelling. High-profile leadership. Massive funding. Major content partnerships. Strong initial download numbers. What Quibi chose to believe was that these signals implied readiness for growth. That belief shaped a series of decisions that prevented crossing the early growth gap. First, Quibi treated downloads and trial usage as evidence of product-market fit, rather than as hypotheses to be tested against repeat behavior. The company optimized marketing spend to increase installs instead of pausing to understand why usage dropped after initial exposure. Second, when retention proved inconsistent, Quibi responded with feature changes and content format adjustments rather than interrogating the core behavioral question: Third, Quibi scaled production and distribution costs before validating a stable loop that turned interest into habit and habit into subscription revenue. Instead of asking whether revenue behavior was repeatable, the company assumed scale would fix engagement. The critical missed decision was this: Quibi optimized for perceived momentum instead of behavioral reliability. Without a stable, repeatable reason for users to return and pay, scaling amplified the mismatch between what the product offered and how people actually consumed media. Quibi did not fail because it lacked demand or resources. Speed Matters Only When It Reduces UncertaintyThere is a popular belief that early growth is about moving fast. That belief is incomplete. You do not need to move fast everywhere. You need to move fast where learning happens. Speed matters in testing willingness to pay, experimenting with packaging, validating channels with real money, and removing founder-only steps. Speed does not matter in hiring, brand building, optimization, tooling, or infrastructure. In early growth, slowness in the wrong places kills learning. Speed in the wrong places kills companies. Founder Dependency Is a Diagnostic, Not a FailureA simple test reveals whether a company is still in validation or approaching growth. What breaks when the founder steps away? If revenue collapses when the founder stops selling, onboarding, explaining, or closing, then repeatability has not yet been found. This is not a moral failure. It is a phase. But the work of early growth is systematically removing yourself from the loop and observing what fails. Every failure maps the real constraints of the business. Stripe crossed the validation to growth gap not because it found demand, but because it made a specific set of choices about what problem to solve next. Early Stripe had validation. Developers wanted an easier way to accept payments. Some were paying. Word of mouth existed. That part was not unique. What mattered was what Stripe chose not to do at that moment. Instead of prioritizing new features, new markets, or aggressive distribution, the founders made a deliberate decision to focus on eliminating non-repeatable revenue behavior. They asked a very specific question: Can a developer who has never met us successfully integrate payments without help? This question shaped several critical decisions. First, Stripe treated failed integrations and payment errors as first-order signals, not edge cases. If a payment failed, it was not “acceptable friction.” It was evidence that revenue could not yet be trusted to repeat. Second, they invested disproportionately in documentation, APIs, and defaults that reduced the need for explanation. This was not a growth tactic. It was a repeatability tactic. Every unclear step was a future scaling failure. Third, they delayed expansion until new users behaved like early users without requiring founder involvement. When developers began integrating successfully without emailing the founders, without bespoke fixes, and without manual intervention, Stripe had crossed the early growth gap. The key decision was this: Stripe optimized for revenue reliability before revenue volume. That choice converted validation into a repeatable engine. Growth afterward was possible because the system no longer depended on exceptional users or exceptional effort. Stripe did not grow because demand existed. Early Growth Is Where Business Models Are ForgedBy the time a company is clearly growing, the business model already exists. Early growth is where pricing shifts from what feels fair to what clears friction. This phase feels like contraction, not expansion. You are compressing possibility space until only a few viable paths remain. That narrowing is progress. Why Most Teams Stall HereTeams stall in early growth for predictable reasons. They confuse activity with learning. None of these feels like mistakes in the moment. They feel like momentum. That is why this phase is so dangerous. The Quiet Shift That Signals Real GrowthThere is a subtle moment when early growth becomes real growth. It sounds like this. Customers buy for similar reasons. Nothing explodes. Nothing goes viral. But anxiety drops. That is the signal. Not traction, but predictability. Growth Is Repeatability With VolumeOnce repeatability exists, growth becomes almost boring. It turns into capacity planning, constraint management, and efficiency tuning. Without repeatability, growth is theater. You cannot scale what you cannot explain. And you cannot explain what you have not tested against money. A Reframe Worth HoldingValidation proves the possibility. Everything else comes later. The real work is quiet. It is observational. It is uncomfortable. But it is the work that earns the right to grow. - Before you build anything, make sure someone wants it enough to pay. I put together a free 7-day email course on revenue-first customer discovery — how to pull real buying intent from real conversations (without guessing, overbuilding, or hoping). If you’re a builder who wants clarity before code: |

Monday, February 2, 2026

Early Growth Is Not Scaling. It Is the Search for Repeatability.

Subscribe to:

Post Comments (Atom)

The Anti-Fragile Startup: Building Business That Get Stronger When Things Break

What makes a startup anti-fragile? Explore Taleb’s theory of fragility, convexity, and how companies can gain from volatility and rapid chan...

-

Crypto Breaking News posted: "Mikhail Fedorov, Ukraine's Deputy Prime Minister and the head of the country's Minist...

-

Techie.Buzz posted: " [ANN] Serverless Kubernetes Solution For Cloud-Native Apps by CTO.ai CTO.ai is a provider of deve...

-

kyungho0128 posted: "China's crackdown on Bitcoin (BTC) mining due to energy consumption concerns is widely regarded as...

No comments:

Post a Comment